Inescapable medical debt and high out-of-pocket healthcare costs create a challenge for RCM and Medical Billing Companies as patients continue to pay an ever greater share for healthcare.

Medical debt is a growing burden for most Americans and the problem is only becoming more acute — for patients, healthcare administrators, Medical Billing, and RCM Companies — in 2024. Many healthcare plan premiums are projected to increase by 10%, (Kaiser Family Foundation) and the maximum out-of-pocket costs for individual and family high deductible healthcare plans have increased to $9,100 and to $18,200, (HealthCare.gov) respectively.

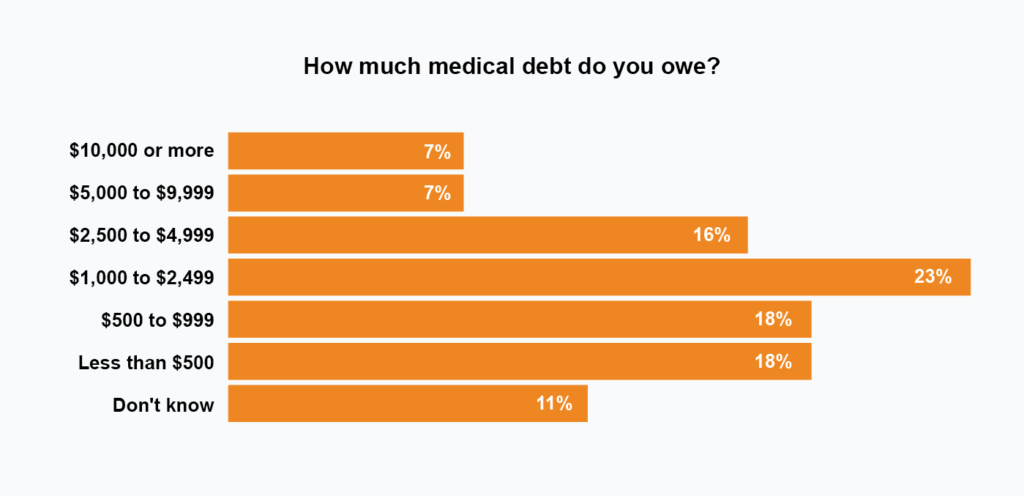

In addition to these rising costs, many Americans are heading into 2023 with unpaid medical bills with more than 1 in 3 US adults carrying a balance according to a survey from healthcare.com. Furthermore, 6 in 10 adults with overdue bills received care knowing it would rack up debt while more than half of outstanding patient balances exceed $1,000.

These findings mirror those from a 2021 survey conducted by The Commonwealth Fund revealing that one-third of insured respondents are paying off a medical bill. And half of all uninsured participants carry a medical balance.

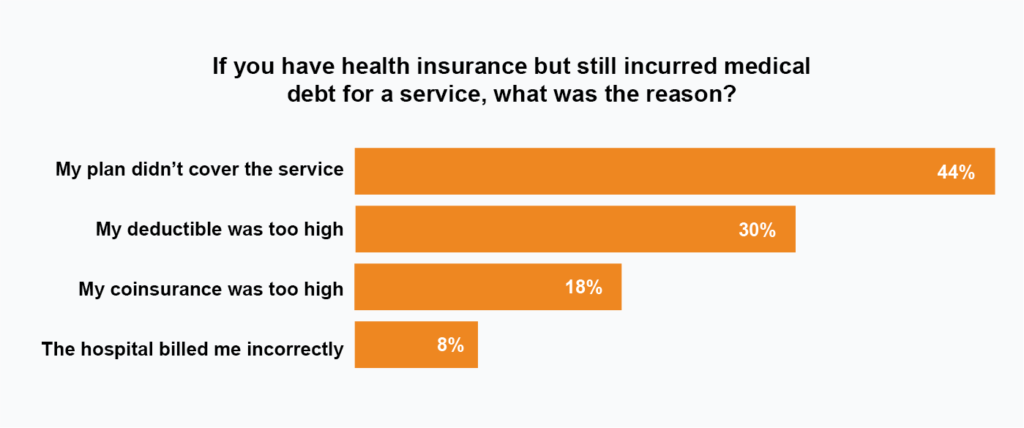

Despite having health insurance, many Americans still carry medical debt. For participants of the survey, 44% incurred medical debt because their health insurance did not cover their treatment. 30% carry a balance because their deductible is too high, and for 18% of respondents their coinsurance was not sufficient to cover all charges.

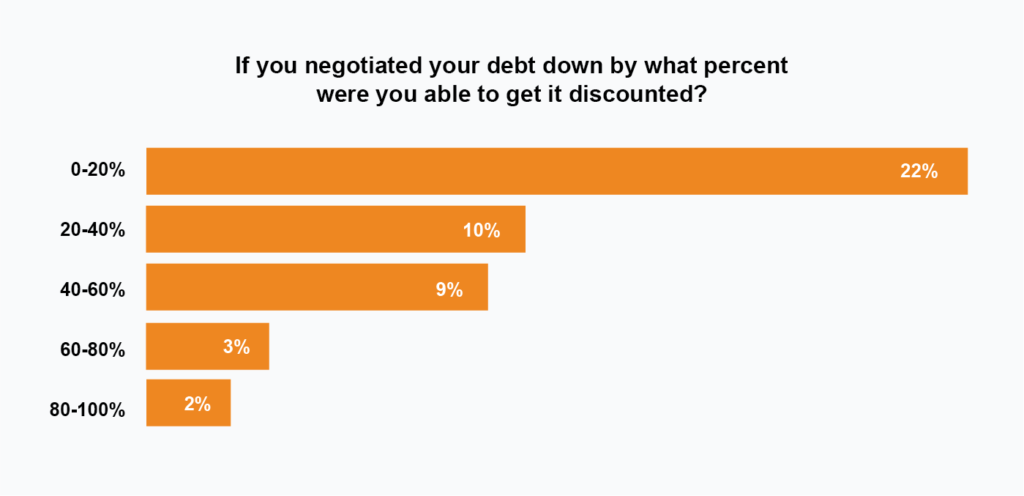

Almost half of Americans with debt try to negotiate a payment plan or a reduction in their balance, creating additional administrative overhead and challenges for RCM companies, as managing patient interactions increase. Of those patients who negotiated discounts or payment plans to manage their medical debt, 31% worked directly with their medical provider, 21% negotiated with a debt collection agency, and 12% with their insurance carrier.

Increases in healthcare expenses and high deductibles in 2024 coincide with a labor shortage in healthcare administration. For RCM companies, the choice to divert labor from managing claims to patient collections carries a high cost. As reported by Medstat, the cost to collect from patients is four times higher than from insurance companies. AI and automation will help RCM companies meet the demands of increased patient interactions while lowering the overall cost to collect.